Homestead

Assessing Links

When you homestead your property you are claiming the property as your primary domicile. This typically means the property you own, occupy, register your driver's license, file taxes, vote, receive mail, etc.

Homestead status can provide a monetary reduction in taxes by reducing the property's taxable market value up to a certain value amount. The program can also qualify you for other programs such as the disabled veterans market value exclusion, senior citizens property tax deferral, and property tax refund.

The homestead classification applies to properties that are physically occupied by the owner or owner's qualifying relative as the principal place of residence. The occupant must also be a Minnesota resident.

Homestead Market Value Exclusion

The State of Minnesota encourages home ownership by providing owner-occupied properties a reduction in their property taxes. The amount of the homestead exclusion varies depending on the market value of the property.

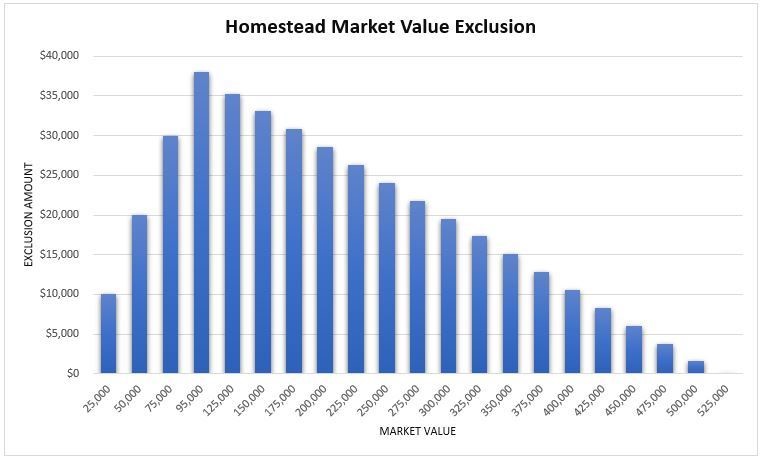

The maximum value amount of the exclusion is $38,000 for residential properties with a market value of $95,000. As the property’s market value increases above $95,000, the amount of the exclusion decreases (shown in the graph below). The homestead exclusion phases out to $0 when the value of the property is $517,200 or above.

The Chart below illustrates how the homestead market value exclusion phases out as the estimated market value of the property increases.

Apply for homestead

Owners/relatives wishing to apply for homestead status in Bloomington may do so:

- By mailing the PDF application to

- Hennepin County Assessor’s Office

300 S. 6th St A-2103

Minneapolis, MN 55487

- Hennepin County Assessor’s Office

- Through Hennepin County's online portal

Questions? Email ao.homestead@hennepin.us or call 612-348-3046

The City of Bloomington Assessor's Office does not accept or process homestead applications.

See below for the list of required documentation that must accompany your application.

New Owners

- Homestead Application

- Supporting Documents:

- Deed and eCertificate of Real Estate Value (eCRV)

(typically provided at closing) - Minnesota Driver's License or Minnesota State ID

- Social Security Numbers for all owners (even for spouses not listed on deed or ITIN if applicable)

- Signature of each owner and spouse

- Deed and eCertificate of Real Estate Value (eCRV)

- Supporting Documents:

Re-Occupying or Existing Owners

- Homestead Application

- Supporting Documents:

- Minnesota Driver's License or Minnesota State ID

- Social Security Numbers for all owners (even for spouses not listed on deed or ITIN if applicable)

- Signature of each owner and spouse

- Supporting Documents:

Relative Homestead

- Homestead Application

- Supporting Documents:

- Deed and eCertificate of Real Estate Value (eCRV)

(typically provided at closing) - Occupant and Spouse Minnesota Driver's License or Minnesota State ID

- Occupant Social Security Number and Spouse's SSN or ITIN (whether occupying or not)

- Owner, Occupant, and spouse's signatures on application

- Owner's current address and contact information

- Deed and eCertificate of Real Estate Value (eCRV)

- Supporting Documents:

For any questions regarding homesteading, please call 952-563-8722 or or visit hennepin.us/homestead

If you own real estate property and you or a qualifying relative occupies the property you may apply for homestead status. You can only homestead one residential parcel (as your primary residence) in the State of MN.

You must have a valid copy of one of the following: Warranty deed or contract for deed, quit-claim-deed, Co-op member certificate, inheritance documents, etc. granting you title to the property as proof of property ownership.

In order to be recognized as a valid deed, the deed must be registered with the Hennepin County Registrar of Deeds. You will also need to provide a copy of the Certificate of Real Estate Value.

You and all other owners must use the property as your main residence – or stated another way, you must live there. Temporary and token occupancy is not considered sufficient to receive a homestead classification.

The property may receive a fractional or partial homestead classification if more than one person owns the property and there are non-related co-owners who do not reside at the property.

Your payable tax statement for this year is based on how the property was valued and classified as of January 2 of last year. Please note; if you did not own and occupy the property by December 1st of last year, and the property was not homestead by the previous owner, the taxes payable this year will be at the non-homestead rate.

A very small number of properties may have property information that list conflicting homestead classification information. Some homestead or other classification database changes occur after the Proposed Tax Statements or Truth in Taxation notices were created but prior to calculation and printing of the Tax Statements which results in the tax amounts being different on the two documents. To check on the homestead status of your property you can call the City of Bloomington at 952-563-8723.

The Market Value Homestead Credit was eliminated by State of Minnesota representatives in their 2011 legislative sessions. HOWEVER, qualifying homeowners will still receive a tax benefit through the "Homestead Exclusion" implemented in its place.

The main difference between the "Credit" and the "Exclusion" is the way it's calculated. The Homestead application and qualifying process remain unchanged. Thus, new Homestead applicants will fill out the same Homestead application for the Exclusion as they would have for the Credit. If your property was already receiving the Credit before the legislative change, you do not need to re-apply for the Exclusion.

For more information on the change from Credit to Exclusion, please contact Minnesota Department of Revenue.

A Social Security Number is how the Department of Revenue tracks homesteads in Minnesota. Social Security numbers will be used to determine if owners or relatives of owners have been granted more than one homestead in the state. Per Minnesota state statute, you can only homestead one residential parcel (as your primary residence) in the State of MN.

A Social Security Number is how the Department of Revenue tracks homesteads in Minnesota. The only time a Tax Identification Number is accepted is if at least one of the owners applying for homestead has a Social Security Number and the other owners can provide their ITIN numbers. However if all of the current owners only have ITIN numbers they cannot be granted a homestead until one of them has a Social Security Number.

The resident should contact their title company or realtor and ask for an amended copy of the eCRV or Deed to keep for their records. We will accept the initial application on hold until the corrected information has been supplied to Homestead Staff.

Yes, only the owner (title holder)/occupant can apply.

Yes, as long as the life estate interest is shown on the deed and the holder of the life estate meets all the homestead requirements.

Most trusts can qualify for homestead. A Certificate of Trust or a copy of the trust must be provided along with a copy of the deed that conveys the property to the trust. Contact the City of Bloomington, (952) 563-8723 for more information.

Yes, for people who are blind or permanently and totally disabled, Minnesota offers special homestead classifications.

The blind person and the blind person’s spouse, per MN Statutes, section 256D.35

A person who is permanently and totally disabled and the disabled person’s spouse as certified by a government or qualifying agency or income-providing source that the homestead occupant satisfies the disability requirements.

Another special program is the Market Value Exclusion on Homestead Property of Qualifying Disabled Veterans

The application for this valuation exclusion is not a substitute for a homestead application. The property must qualify for a homestead classification before being granted valuation exclusion under this program.

There are two levels of exclusion for disabled veterans:

- For veterans with "70 or more percent service-connected disability" a market exclusion of $150,000 is available on homestead property. This includes veterans with a 100% disability that is not considered permanent. Veterans in this category must reapply annually with the City of Bloomington Assessor’s Office. Veterans must apply by July 1st using Form CR-DVHE70 to the City of Bloomington Assessor's Office to be eligible for the reduced tax program for the next year's payable taxes.

- For veterans with "total (100 percent) and permanent service-connected disability", a market exclusion of $300,000 is available on homestead property. If the veteran is able to verify that they are considered totally and permanently disabled by the U.S. Veterans Administration, then they must apply by July 1st using Form CR-DVHE100 to the City of Bloomington Assessor’s Office to be eligible for the reduced tax program for the next year’s payable taxes. Once approved for the market value exclusion, totally and permanently disabled veterans do not need to reapply. The property will continue to qualify for market value exclusions until there is a change in ownership or use of the property. For veterans with total and permanent disability only, a surviving spouse can also continue to qualify under this provision so long as the surviving spouse owns the property and resides there, until the spouse sells, transfers, or otherwise disposes of the property.

Neither the Department of Revenue nor the City of Bloomington Assessor’s Office is responsible for determining disability status of veterans. Applicants requiring information concerning their discharge or disability status must work with their County Veterans Service Office or the Veterans Administration to receive this information from the V.A.

If at any time the property is sold, or you change your primary residence you are required to notify the assessor’s office in writing, within 30 days.

Falsifying a homestead is punishable by imprisonment for not more than one year or payment of a fine of not more than $3,000, or both.

If the assessor is NOT notified within 30 days that the property has been sold or is no longer being used as a primary place of residence, the homestead status will be removed and penalties will be imposed.