As with many suburbs that were built out in the 1950s and 1960s, many of Bloomington’s facilities need upgrades replacing. The City Council has asked the state legislature to approve a half-percent sales tax to fund $155 million in projects. If approved, the sales tax proposal would then be up for final approval by voters in November 2023. Residents will also be able to vote on each project separately.

Proposed projects

- $20 million: Nine Mile Creek Corridor renewal.

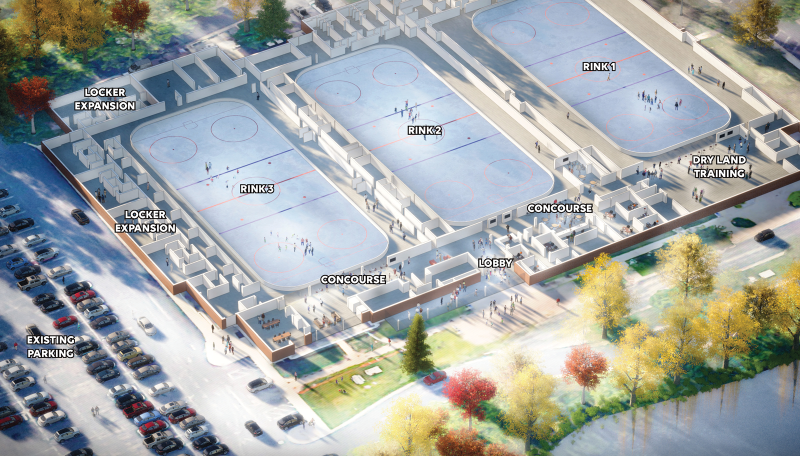

- $35 million: Bloomington Ice Garden renovation, including a new roof.

- $100 million: Creekside Community Center and Public Health building replacement.

Sales tax versus property tax

- Cities have two primary ways to pay for community improvements—sales taxes and property taxes. Here’s how the cost could break down for each funding option:

- If the projects were funded by sales tax, it would require $72 in additional sales tax for each of Bloomington’s 38,000 households per year. With this option, more than two-thirds of necessary funding would be paid by nonresidents.

- If the projects were funded through property taxes, the property tax bill for a median-value home would increase by $210 per year.

The sales tax option reduces the share of funding for each median-value home by about $138 annually. For more information about the proposed Bloomington sales tax, visit bloomingtonforward.org.